Joe Biden Signs COVID-19 Relief Bill

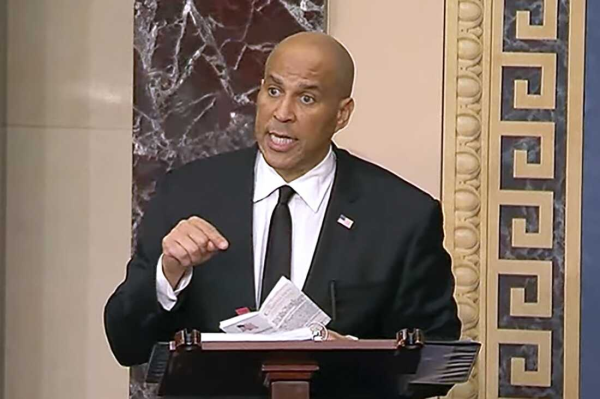

Mandel Ngan, AFP Via Getty Images

Joe Biden signed the $1.9 trillion relief bill which is focused on providing stimulus checks, helping with unemployment, combating the virus, and reopening schools.

On March 11, 2021, President Joe Biden signed his first piece of major legislation aimed at providing aid for a struggling American economy. This legislation is a $1.9 trillion stimulus check that was signed into law on March 11th; $1.9 trillion could also be represented as approximately 8% of the United States GDP. The bill is designed to combat the effects of the COVID-19 pandemic and the resulting economic recession. Chuck Schumer, the Senate majority leader from New York said “We will end this terrible plague and we will travel again and send our kids to school again and be together again.” The Biden administration called the bill the American Rescue Plan, describing it on the White House website as an “Emergency Legislative Package to Fund Vaccinations, Provide Immediate, Direct Relief to Families Bearing the Brunt of the COVID-19 Crisis, and Support Struggling Communities.”

The part of the bill that made headlines was the $1,400 stimulus checks that will be issued to all individuals earning up to $75,000 and couples earning up to $150,000. The goal of this is to help average working-class Americans pay their bills and also to enable them to spend their money in the American economy. These checks will reach upwards of 160 million people according to the IRS. Although this is a major part of the bill, it only accounts for $400 billion of the total $1.9 trillion bill.

The bill appeared to have bipartisan support among voters based on polling. The Pew Research Center reported that 70% of American adults were in favor of the bill, including 41% of Republicans. But these numbers did not reflect the subsequent vote in Congress. Not a single Republican voted in favor of the bill. Many of their objections have been centered around the large spending that is permanent and not exclusively designed to combat the virus. Republican Congressman Jodey Arrington of Texas described the bill as “…this is not COVID relief. It’s a $2 trillion blue-state boondoggle and a Trojan horse for their reckless partisan policies. It’s because Speaker [Nancy] Pelosi is throwing your tax dollars at Democrat cronies like a float captain throws beads at a Mardi Gras parade.”

One of the major parts of the bill is $350 billion allocated to the state, local, and territorial governments, with $195.3 billion to states, $130.2 billion to cities, $20 billion to tribal governments, and $4.5 billion to other territories. The $195.3 billion to states is distributed through a formula that is largely reliant on individual states and the number of unemployed citizens. This money will go towards counteracting the lost revenue from the pandemic. Specifically, it will be used to effectively distribute the vaccine, pay public workers, increase testing, and contribute toward the cost of reopening of schools.

The federal government is extending the unemployment benefits of $300 a week until September 6th. This is an addition to state unemployment benefits. Unemployed workers that were laid off will also remain on their prior employer’s health insurance at no cost to the recipients and the employer.

The Biden administration has put a very strong emphasis on trying to reopen schools, saying back in February that he would get K-8 students back to school 5 days a week. The legislation provides $130 billion to be given to public schools in an effort to get closer to reopening. According to the White House website, the money will be put toward, “reduce[ing] class sizes and modify[ing] spaces so students and teachers can socially distance; improve ventilation; hire more janitors and implement mitigation measures;[and] provide personal protective equipment…” Colleges and universities will also receive $40 billion to be used to pay for any expenses that are connected to the pandemic and to give students in need food and housing.

Another highlight of the bill is the money allocated towards directly combatting the virus. $50 billion is going towards increased testing and further monitoring of the virus. The CDC will receive $7.5 billion to create distribution centers for the vaccine, as well as $1 billion to create a campaign to encourage vaccinations and to spread awareness.

The bill will also give aid to businesses that were very negatively impacted by the virus. Restaurants and bars will receive $28.6 billion in grants to cover expenses that are not exclusively COVID related. This will allow these businesses to continue paying their employees and pay other expenses such as utilities and rent. $7.5 billion is going to be given to the Paycheck Protection Program, which provides loans to help businesses keep their employees on their payroll.

Lower-income households with children will also get a further income tax credit of $2,000 to $3000 for children from 6 to 17, and $3600 for every child under 6. This increased tax credit is available to single parents with an income up to $75,000 and joint incomes up to $150,000. According to the Center on Poverty and Social Policy at Columbia University, this legislation in combination with the $1,400 stimulus checks will reduce the number of children living in poverty by half.

Brian Hulea • May 18, 2021 at 12:04 pm

John, very good article. Sometimes I forget about the Fordian. Very informative, thank you.